In the Indian financial landscape, choosing the right investment avenue is crucial for tax planning and wealth creation. A PPF account in post office has consistently been a preferred choice for investors seeking secure, long-term, and tax-efficient returns. The government-backed Public Provident Fund (PPF) scheme offers a unique combination of guaranteed returns and tax benefits. Especially in recent years, with the importance of the PPF budget gaining momentum among taxpayers, many are keen to understand why opening a PPF account in the post office stands out as a reliable option. Alongside, investors can also consider complementary financial products like Bajaj Finance FD for diversifying their fixed-income portfolio.

This article explores the significant advantages of opening a PPF account in post office, its role in tax-saving, and comparisons with other investment options such as fixed deposits, with a special focus on the attractive FD rates of Bajaj Finance FD.

What is a PPF account in Post Office

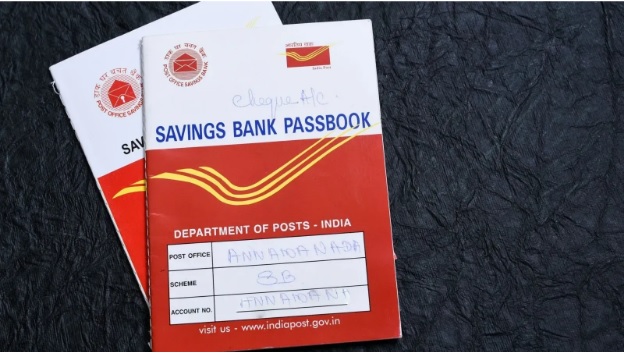

A PPF account in the post office is a government-backed savings instrument aimed at encouraging long-term investments. It is managed by the Ministry of Finance and operates through an extensive network of post offices across the country. The post office acts as a trustworthy intermediary for thousands of investors who prefer handling their financial transactions offline or over-the-counter.

The minimum lock-in period is 15 years, providing tax-free interest and maturity amounts, making it one of the most secure and tax-efficient instruments. Investors can open an account with a minimum deposit of Rs. 500 per financial year and contribute up to Rs. 1.5 lakh annually, which qualifies for the highest deduction under Section 80C of the Income Tax Act.

Benefits of opening a PPF account in Post Office

Safe and government-backed investment

One of the foremost reasons to open a PPF account in post office is the safety offered by the government guarantee. Unlike corporate fixed deposits, which carry credit risk, a PPF account guarantees the principal and interest without any market-linked volatility.

Attractive tax-free returns

PPF interest rates are fixed by the government each quarter, currently hovering close to 7.1%, providing consistent returns. More importantly, the interest earned and the maturity amount are entirely exempt from income tax, enhancing the effective yield.

Tax saving under section 80C

Contributions to a PPF account are eligible for tax deduction of up to Rs. 1.5 lakh per annum under Section 80C. This deduction leverages the investor’s overall tax planning strategy and helps reduce taxable income by a significant margin.

Flexibility in contributions and loans against the balance

Post offices allow investors to deposit amounts ranging from Rs. 500 to Rs. 1.5 lakh a year. Besides, after the third financial year, investors can avail of loans against their PPF balance, providing liquidity without liquidating investments.

Significance of the PPF budget for investors

The term PPF budget often refers to the annual revisions and rate announcements made by the government concerning the PPF scheme. This budgetary update is significant because it directly impacts the attractiveness of the PPF as an investment option.

In recent fiscal budgets, the PPF rate has been kept stable to encourage small savers and middle-class investors. Stability in PPF budget rates offers predictability in returns, unlike market-linked products, making it a preferred choice for conservative investors.

Comparison between PPF account in post office and fixed deposits

Fixed deposits, especially those offered by reputed NBFCs and banks such as Bajaj Finance FD, are popular for their fixed returns and flexible tenure options. However, there are notable differences when compared to a PPF account in post office.

| Feature | PPF Account in Post Office | Bajaj Finance Fixed Deposit |

| Tenure | 15 years (lock-in period) | 12 months to 60 months (flexible tenure options) |

| Interest rate | Around 7% (government-declared, revised quarterly) | 6.60% to 7.30% (varies by tenure and customer category) |

| Tax treatment | Interest + maturity amount fully tax-exempt (EEE) | Interest is taxable unless under specific exemptions |

| Risk level | Government guaranteed, extremely low risk | Subject to credit risk, but Bajaj Finance FD is highly rated (CRISIL AAA/STABLE) |

| Liquidity | Partial withdrawals/loans allowed after 3 years | Premature withdrawal available with certain conditions |

Bajaj Finance FD rates for senior citizens and others

For senior citizens, Bajaj Finance FD offers the following interest rates per annum:

– 12 to 14 months: 6.95% p.a.

– 15 to 23 months: 7.10% p.a.

– 24 to 60 months: 7.30% p.a.

For non-senior citizens, the rates are slightly lower:

– 12 to 14 months: 6.60% p.a.

– 15 to 23 months: 6.75% p.a.

– 24 to 60 months: 6.95% p.a.

These competitive rates make Bajaj Finance FD a strong contender alongside PPF accounts for investors seeking stable income.

Why diversify between PPF account and Bajaj Finance FD

While a PPF account in post office offers long-term, tax-free returns with peak safety, it has limitations such as less liquidity and a long lock-in period. To balance these constraints, investors can complement their portfolio with fixed deposits from entities like Bajaj Finance FD.

Bajaj Finance FD provides flexibility in tenure, attractive interest rates, and relatively easy liquidity options through premature withdrawals. Combining both instruments allows investors to:

– Maximise tax savings via PPF contributions.

– Earn better interest income on shorter durations with Bajaj Finance FD.

– Have a safety net of government-backed security while capturing higher yields on FDs.

– Plan financial goals with a balance of liquidity, safety, and tax efficiency.

How to open PPF account in post office

Opening a PPF account in post office is straightforward and accessible for all Indian residents. The following steps outline the process:

1. Visit the nearest post office: Investors need to visit a local post office branch where the PPF scheme is available.

2. Fill the application form: Submit Form A for opening the PPF account along with valid ID and address proof.

3. Initial deposit: A minimum deposit of Rs. 500 is mandatory to open the account.

4. Maintain yearly deposits: Investors can make subsequent deposits online or at the same post office, ensuring the total per financial year does not exceed Rs. 1.5 lakh.

5. Account maintenance: Passbooks are issued and updated with every transaction.

The long-standing post office network ensures that PPF account holders can avail services even in remote areas, making it ideal for all demographics.

Conclusion

Choosing to open a PPF account in a post office remains one of the smartest decisions for Indian investors aiming for long-term, tax-free returns with the highest safety standards. The government-backed guarantee, coupled with consistent interest rates declared in the PPF budget, ensures reliable and predictable investment growth.

However, to build a comprehensive fixed-income portfolio, one should also consider placing funds in reliable fixed deposits like the Bajaj Finance FD, which offers competitive interest rates ranging from 6.60% p.a. to 7.30% p.a. based on the tenure and age of the investor. This combination can optimise tax benefits while ensuring liquidity and higher yields.

A balanced approach with a PPF account in post office for stability and Bajaj Finance FD for flexibility and attractive returns is an ideal strategy for disciplined investors focused on long-term financial planning in India.