Why CIBIL Consumer Login is Essential for Credit Management

Understanding and managing your financial health is an integral part of a healthy lifestyle. In India, one of the key components of financial management is understanding and maintaining a good credit score. The Credit Information Bureau (India) Limited or CIBIL, is India’s oldest credit information company, providing credit-related services to its members nationwide. In this context, an individual’s access to the CIBIL consumer login plays a crucial role in credit management.

The Importance of CIBIL Consumer Login

Let’s delve into why the CIBIL consumer login is essential for credit management. This portal is not just an exchange of access credentials; it is your gateway to understanding your financial habits and creditworthiness.

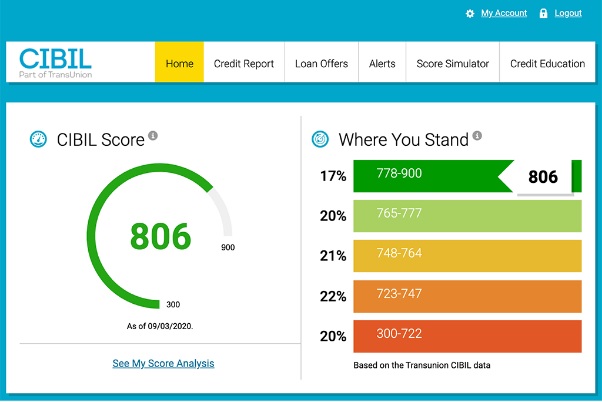

One of the significant aspects of the CIBIL consumer login is access to your credit score, otherwise known as the CIBIL score. Banks, financial institutions, or even mobile network operators adhere to the CIBIL score as a reliabile reference for analyzing an individual’s credit behavior. When you apply for any loan or credit card, institutions refer to your credit report to evaluate your creditworthiness. A higher CIBIL score indicates a better credit history, increasing your chances of easy credit approvals.

Understanding CIBIL Score Login

Your access to the CIBIL score login determines your status in the financial world as a prudent borrower or a debt trap candidate. Regular checking and knowledge about your CIBIL score keep you symbiotically linked to the different elements of credit management. The simple act of logging in provides a comprehensive overview of your credit habits and aids in planning your financial future.

Keeping Track of Your Financial Health

When it comes to improving financial health, staying in the loop is half the battle won. The CIBIL consumer portal helps you stay on top of things. An individual with regular CIBIL score login stands a better chance for successful credit applications in comparison to someone ignorant about their score.

Potential lenders and banks evaluate your credit history reflected in the CIBIL score to gauge your financial reliability. This makes the CIBIL consumer login a critical tool in managing your credit efficiently.

Transparent Credit Transactions

The power to monitor all credit activity in a transparent manner is unlocked with the CIBIL consumer login. All your financial data, including past and current loans and credit cards, are centralized in a single platform. This allows individuals to spot any discrepancies, track and control credit activities, and plan for future borrowings.

Dispute Resolution

In case of discrepancies in your CIBIL report, the CIBIL consumer login serves as a point of correction. Ranging from personal detail errors to transaction related mix-ups, the provision of dispute resolution ensures all data considered for your CIBIL score is accurate.

Facilitating Financial Discipline

Access to your credit score and credit history through the CIBIL consumer login encourages financial discipline. Awareness of how defaulting payments or maximizing credit limit can affect your credit score helps in inculcating better financial habits. Regular reviews of your credit report also comes handy during loan negotiations, giving you the power to negotiate better terms.

Improving Lending Experience

Your CIBIL score login helps lenders understand your credit habits and repayment capacity, enabling them to streamline their services for meeting your needs. Thus, a good credit score through prudent financial management can enhance your borrowing experience.

In conclusion

CIBIL consumer login is a fundamental tool for efficient credit management. It not only gives an insight into your financial health but also sets the base for a secure financial future. Building and maintaining a good CIBIL score represents a strong footing in the financial realm. The success of any financial endeavor, including loan applications, purchase of a new home or setting up a new business, hinges on a strong CIBIL score backed by sound credit management.

Credit management is no longer a daunting task in the backdrop of digital convenience offered by the CIBIL consumer login. Knowing and comprehending our CIBIL score makes us ready for today, and more importantly, prepared for a financially sound tomorrow.